With all the social and environmental changes that affect the world around us and our daily lives, we need to put the very best results of our scientific endeavour into real, commercial use. Deep Tech is the world of research-heavy start-ups; companies formed around new science and frontier technologies.

Start-ups based on Deep Tech are very attractive investment cases. Typically, these companies have a high barrier of entry and thus an extremely strong competitive advantage. VCs are rediscovering the sector, and as a result, investments in this area have increased by 20% annually over the last 5 years and there is still room for growth.

There are three key attributes of Deep Tech start-ups:

– Potential for huge societal and industrial impact

– Can take a long time to reach commercial maturity

– Potentially capital intense

But how do we maximize the impact? How do we mitigate the potentially long lead times and large capital requirements? Join us for the Deep Tech track on February 6th by Industrifonden and Voima Ventures as they help us explore the mysterious world of Deep Tech. Some of the topics we will discuss are:

- “Why Science has returned to the Venture Capital mainstream” by Dr. David Sonnek, CEO of Industrifonden.

- Deep Tech Future Gazing – “The Science of Today is the Technology of Tomorrow” with Dr. Alex Basu, Prof. Håkan Engqvist, Dr. Alvaro Martinez Barrio and Ass. Prof. Johanna Björklund.

- How to Build Deep Tech companies – “The Lean Deep Tech Startup” with Rebecka Löthman Rydå, Jussi Sainiemi, Aline de Santa Izabel and Dr. Ulric Ljundblad

Industrifonden is one of the larger venture capital funds in the Nordics, focusing on the Technology and Life Science sectors. Industrifonden has made about 1000 investments since 1979 and manages over €600 million in assets.

Voima Ventures is a Nordic deep tech VC fund. They invest and help uplift start-ups with a scientific foundation into global markets. They recently launched a €50 million deep tech fund.

So don’t miss this opportunity, they will be looking for bright ideas.

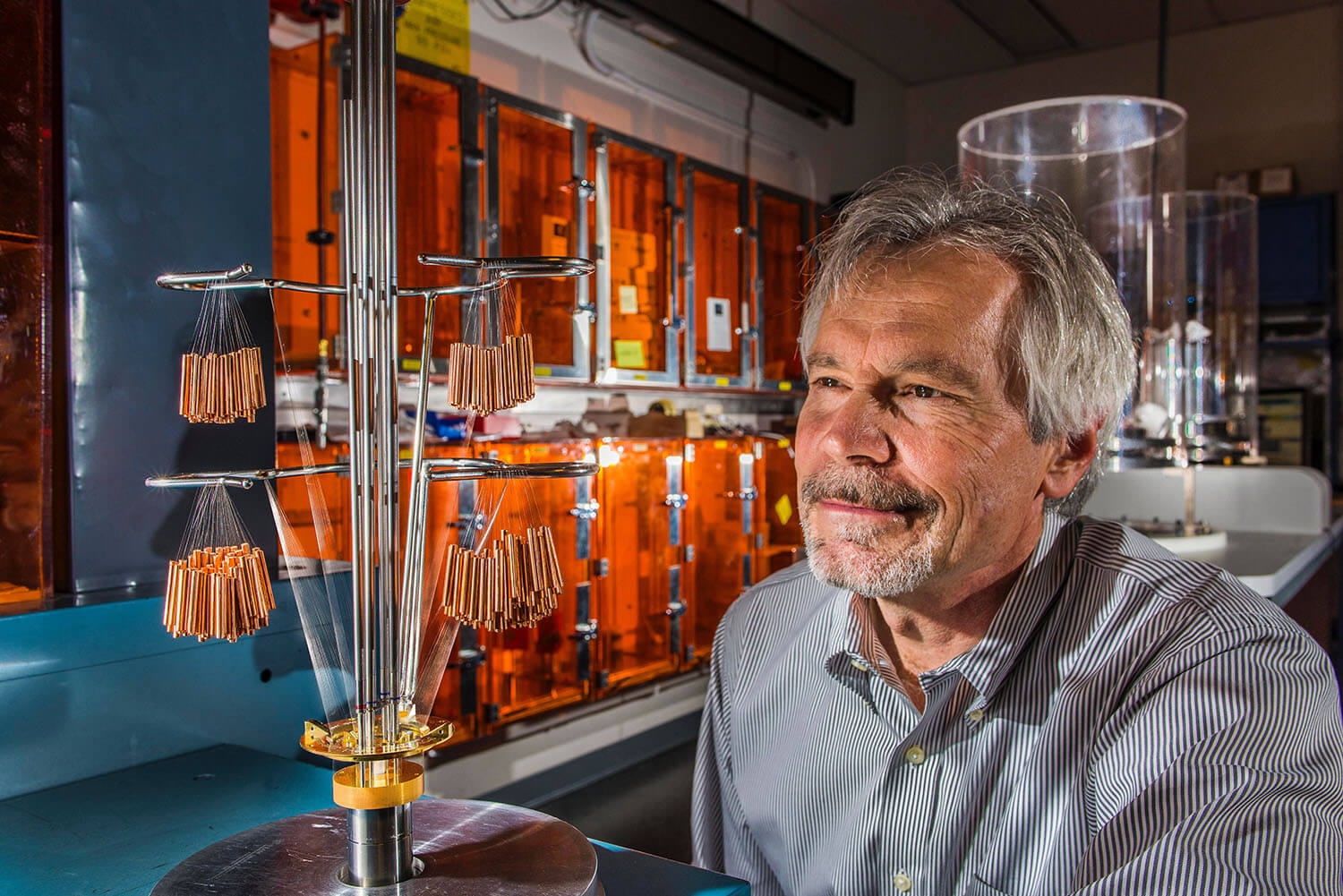

Here are some of our speakers: David Sonnek is CEO at Industrifonden. He has experience form 20 years of VC investing and has held executive positions within strategy, marketing, and product development in the telecommunications sector. David has a research background in experimental atomic physics as well as in finance.

David Sonnek is CEO at Industrifonden. He has experience form 20 years of VC investing and has held executive positions within strategy, marketing, and product development in the telecommunications sector. David has a research background in experimental atomic physics as well as in finance.

Rebecka is investment manager at Industrifonden. For the past seven years Rebecka has worked in VC and with start-ups, most recently as investment manager at venture capital firm Zenith Group and before that Varenne Investment. Rebecka has a lot of SaaS B2B experience, as well as a special interest in AI/ML and FoodTech. She is passionate about solving the problems of tomorrow with truly innovative technology.

Alex is an investment analyst at Industrifonden. Prior to joining Industrifonden in 2019, Alex was at the Nordic investment fund Alder, and from several entrepreneurial ventures, he has gained valuable operational experience. He holds a Master of Science in Biotechnology Engineering and a PhD in Engineering Physics with specialization in Nanotechnology and Functional Materials, both from Uppsala University. Altogether, Alex possesses a unique skill-set for the assessment of investments in highly technical and scientific ventures.

Jussi has broad experience in seeking investment opportunities, forming international investment syndicates, raising large B/C-rounds, hiring board directors, pivoting business models and managing exit processes.