At the inaugural NORDEEP Nordic Deep Tech Business Summit, one of the larger venture capital firms in the Nordics, Industrifonden, was hosting an awe-inspiring track named Scaling to the Moon and Beyond, where fresh insights about the wellbeing of deep tech ecosystem in Europe were presented and discussed. Before diving deeper into this track, here are a few inferences from it:

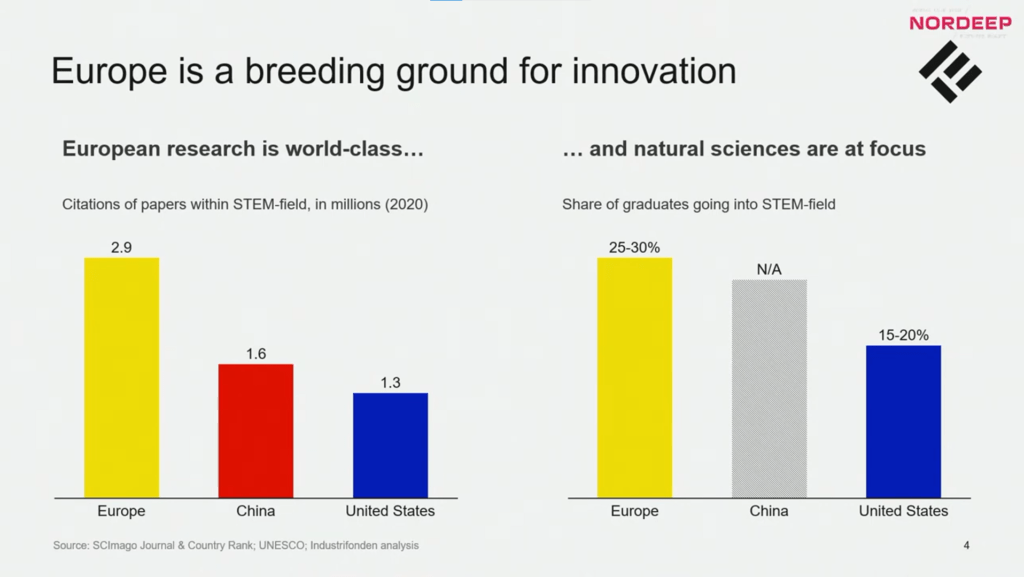

- Europe is ahead of its competitors when it comes to scientific studies and innovations.

- Although investments in Europe in general have decreased recently, the interest in deep tech seems to have gone the other way.

- It is estimated that by 2025, investments in deep tech will be around 150 billion dollars.

- Deep techs make profits later than other startups due to intense R&D studies. Therefore, they need later stage investments.

- Once a deep tech succeeds, it becomes much more valuable than any other startup.

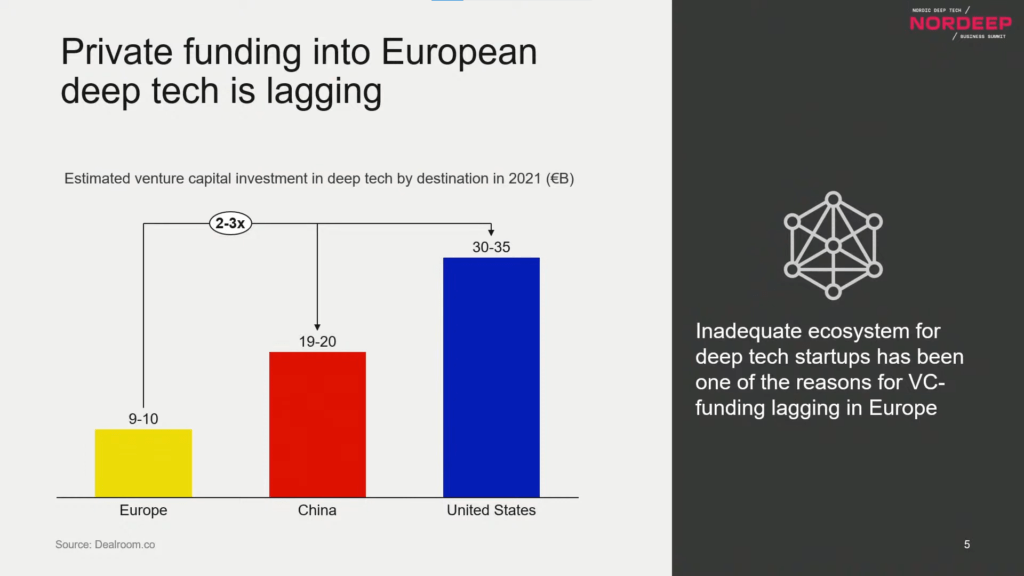

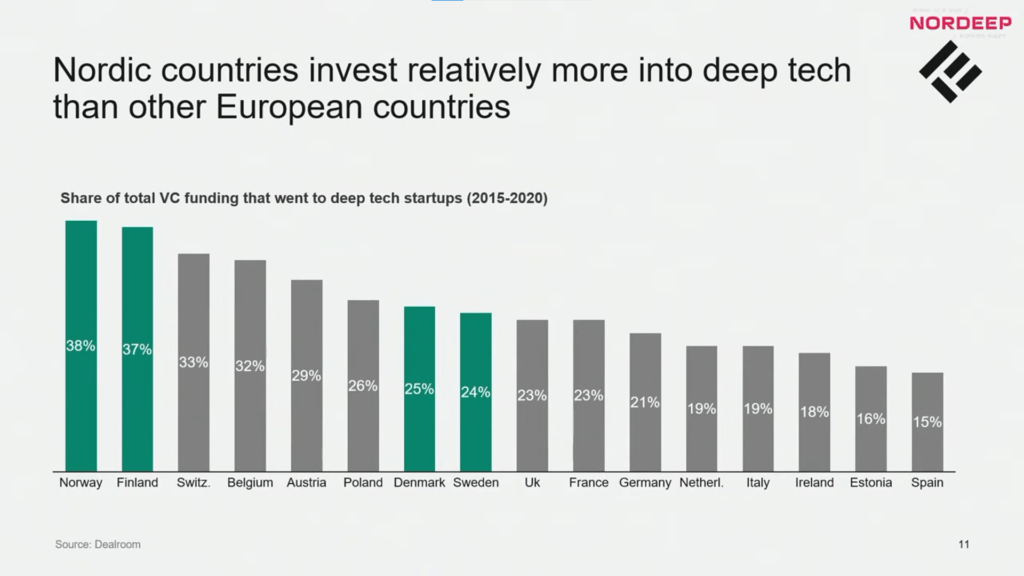

- Nordic countries invest relatively more into deep tech than other European countries.

- EIF is the largest contributor to funding in EU in terms of deep tech initiatives.

- European deep tech startups also need the support of pension funds.

- New deep tech initiatives are on the way.

Deep Tech Climbing in Europe: Deeper look at the session “European Deep Tech Funding Landscape” by Industrifonden at NORDEEP Summit 2022

The first session in this NORDEEP Summit track was European Deep Tech Funding Landscape, a very insightful keynote speech by Patrik Sobocki, Investment Director of Industrifonden. As you can tell from its name, the session offered an overview of the deep tech trends in Europe. It seemed to explain why we, as Arcticstartup, stepped into deep tech area from the very beginning. Of course, deep tech wasn’t born yesterday, but it’s definitely on the rise.

Patrik Sobocki took the stage by addressing one of the biggest challenges the deep tech ecosystem faces, which is clear as day. Patrik began his speech with the following statement:

“We, Europeans, are excellent in making science with money. But we are not so good in making money out of science.”

– Ursula von der Leyen, opening speech at EIC.

Europe in fact have a potential in terms of growing innovations. Patrik shared an eye-opening data on this issue. If you examine the image below, you can see that Europe is ahead in terms of innovations and scientific studies published when compared to China and the US, which are the biggest competitors of Europe.

However, what was pointed out in this part of the session was the funding gap, the lack of investments which have been a massive barrier against these innovations. Compared to these two countries, unfortunately, Europe lags behind at this stage. As Patrik said, when it comes to deep tech, yes, there is a reasonable amount of early investment support, but in the later stages these startups are struggling to find one. Considering that the companions of deep tech inventions are R&D and plenty of waiting, the importance of this matter will be understood and well-emphasized.

Good news is that global investments in deep techs are increasing, and the projected figure for 2025 is approximately 150 billion dollars. So, the interest in deep tech seems to continue. Even we might say that this will be a necessity rather than a choice, especially considering the expected change the world might need. Although investments seem to have decreased recently when looking at Europe, the table taken from Hello Tomorrow & BCG and presented by Patrik points out to a highly noticeable increase in deep tech investments.

Scaling a startup company is hard. But when it comes to a deep tech company, it is harder. Many deep tech startups are struggling to grow or die for various reasons such as fundraising, sales & production and organization & execution. It should be underlined that these include ideas that will shape the future, our future and even save the world. Deep techs cannot have a quick feedback on the success of their ideas at early stages and the real reflections of their work in the market. That’s why it provides better results much more later than the time when the idea emerged, especially compared to other startups in terms of making a profit. But once a deep tech succeeds, the value of the company becomes much more valuable.

There are many successful startups, some of which have become unicorns. Of course, Patrik also mentioned a few companies to exemplify their deep tech achievements. These were ICEYE from Finland, Graphcore and Oxford Nanopore Technologies from Britain, Prophesee and Kalpay from France.

“Sometimes in the Nordics, we’re very humbled to what have we achieved but actually if look at relative funding overall that goes into deep tech. Many of the Nordic countries are actually lining up as primary countries deploying most into the deep tech area.” states Patrik Sobocki about what’s going on in the Nordics when it comes to deep tech.

As we can see from the table Patrik brought to this session, Norway is taking the lead with 38% in terms of total VC funding in deep tech startups. With 37% share, Finland is in the second line. Denmark and Sweden are coming the seventh and eighth in this table but they are still in good digits. We also see Estonia representing Baltics by holding 16% share of total VC funding.

Interestingly enough, investments towards deep techs in the US are coming from pension funds while in Europe EIF is taking the lead.

“In the Nordic countries, there is a lot of governmental funding that goes in. So unlocking the potential for scaling companies obviously also has systematic effects on how LPs are deploying their funding into venture firms. Our conclusion is really that this needs to shift.” says Patrik Sobocki in the European Deep Tech Funding Landscape session at NORDEEP Nordic Deep Tech Business Summit 2022.

Industrifonden has been investing in deep tech companies over the years and realized there is a funding gap that deep tech startups have been facing. With his emphasizing on their tending to collaborative work with others, Patrik also mentioned that earlier this year, they at Industrifonden initiated Deep Tech Venture Collective which gathers some of the leading venture funds across Europe to boost the deep tech ecosystem in the best possible way.

In the second session at NORDEEP Nordic Deep Tech Business Summit, Lise Rechsteiner from Vsquared Ventures, Jacob Fellman from NGP Capital and Emily Meads from Speedinvest joined Patrik Sobocki to discuss scale-up challenges.

At the very end of the track, Iliam Barkino from Industrifonden moderated an interesting session called “Live Pitch Doctoring” where Jan Goetz, CEO & Cofounder at IQM Quantum Computers and Lech Ignatowicz, CEO & Cofounder at Molecular Attraction got instant feedback on their fundraising pitching. You can watch the second day of the summit here and learn more through these two startups’ journeys and issues in scaling up.

Click here to read more about deep tech.