As the Baltic startup ecosystem continues to redefine norms and propel itself onto the global stage, the unveiling of the Baltic Startup Funding Report by Change Ventures and FIRSTPICK paints a vivid picture of the funding dynamics shaping the region’s entrepreneurial journey. The report casts a spotlight on the nuanced dynamics that underpin the growth and investment landscape in Estonia, Latvia, and Lithuania.

The Baltic Startup Funding Report, a collaborative effort by Change Ventures and FIRSTPICK, serves as a comprehensive semi-annual exploration of the funding landscape in the Baltics. Focused on startups based in Estonia, Latvia, and Lithuania, the report meticulously tracks venture funding news and confidentially engages founders to extract valuable insights into the valuation and investment terms of pre-seed and seed rounds.

With data from over 60% of closed rounds in the past 42 months, the report offers a nuanced understanding of the region’s startup ecosystem. The coverage of 954 registered funding rounds from H1 2019 to H2 2023 provides a robust foundation for assessing the dynamics of the Baltic startup scene. The report defines a “Baltic startup” and offers valuation data for 491 pre-seed and seed rounds, showcasing its dedication to transparency and its role as a vital resource for founders and investors navigating the intricacies of the Baltic startup landscape.

Here are the key highlights and takeaways from the latest survey conducted through H2 2023.

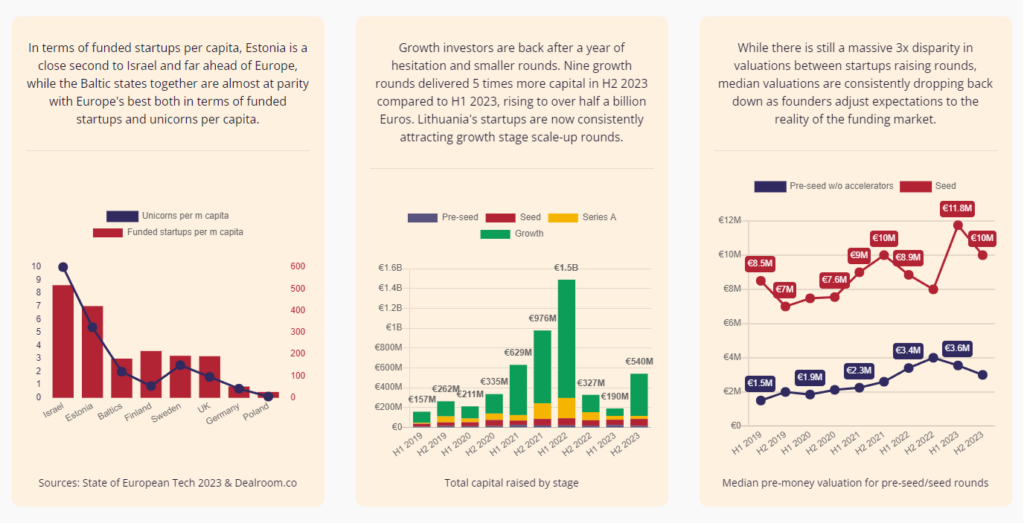

- The Baltic states, particularly Estonia, exhibit a significant presence in the startup ecosystem, with Estonia closely following Israel in terms of funded startups per capita and leading Europe.

- The Baltic states have produced notable unicorns, including Veriff, Skype, Bolt, and Wise, contributing to a robust startup environment.

- Despite a slowdown in pre-seed and seed capital deployment, growth rounds have surged, with the total capital deployed almost tripling in H2 2023 compared to the previous six months.

- Series A rounds remain a substantial hurdle for founders, with only four A rounds in each of the last two half-years, emphasizing the fundraising challenge at this stage.

- Pre-seed and seed capital deployment is stagnant, with a decrease in the number of pre-seed rounds in H2 2023. Investors are becoming more selective, leading to a concentration of funding in mature and less risky startups.

- Although there is a 3x disparity in valuations among startups, median valuations are decreasing as founders align expectations with market realities.

- The Baltic funding market witnessed a significant shift in round structures, with a decline in equity investment and a rise in convertible notes, showcasing a preference for quicker and simpler funding methods.

- Lithuania emerges as a leader in growth capital and growth rounds in H2 2023, challenging Estonia’s dominance. The total amount raised between Estonia and Lithuania has equalized.

- As Latvia and Lithuania’s early-stage activities grow, a more competitive landscape is anticipated, potentially leading to advancements in later funding stages and emulating Estonia’s development pattern.

Estonia, a nation seemingly dwarfed by its global counterparts, emerges as a giant in the startup arena. Following closely Israel, Estonia flaunts the second-highest number of funded startups per capita in Europe. Unveiling unicorns like Veriff, Skype, Bolt, and Wise, the Baltic states paint a portrait of innovation that resonates far beyond their geographical confines.

Yet, the report does not shy away from the stark realities facing founders in the Baltic region. While pre-seed and seed capital deployment experiences a perceptible slowdown, growth rounds surge, witnessing a nearly tripling of total capital deployed in the latter half of 2023. Series A rounds, however, present a formidable hurdle, with a mere four occurrences in each of the past two half-years.

As the spotlight turns to the nuances of funding dynamics, a discerning eye notes a shift in investor behavior. Pre-seed and seed capital deployment stagnates, prompting investors to adopt a more discerning approach, concentrating funding on mature and less risky startups.

Valuations, a currency of their own in the startup realm, reveal a compelling narrative. Despite a 3x disparity among startups, median valuations experience a downward trajectory, reflecting a recalibration of founder expectations with market realities.

The once-familiar landscape of equity investment undergoes a metamorphosis, as convertible notes take center stage. A surge in their usage, particularly in pre-seed funding, signals a preference for expediency and simplicity in securing funding.

Lithuania, often overshadowed, emerges as a force in growth capital, challenging Estonia’s long-standing dominance. The equilibrium in the total amount raised between Estonia and Lithuania hints at a potential shift in the competitive dynamics, with Lithuania poised as a rising star.

As the early-stage activities in Latvia and Lithuania gain momentum, a competitive landscape takes shape, promising future developments in later funding stages. It is a testament to the resilience and adaptability of the Baltic startup ecosystem, positioning itself as a formidable player on the global stage.

In a landscape characterized by unpredictability, the return of growth rounds stands out as a beacon of hope. Growth investors, once cautious, inject capital at a rate five times higher in the latter half of 2023, showcasing a remarkable turnaround. Lithuania, in particular, shines as a beacon of resilience, consistently attracting growth-stage scale-up rounds.

Series A funding, however, remains an elusive milestone for founders, emphasizing the critical need for strategic support in this pivotal stage of a startup’s journey. The uncharted waters between early-stage funding and substantial growth financing present a challenge yet to be fully navigated.

The canvas of pre-seed and seed capital deployment portrays a nuanced narrative. While growth rounds flourish, there is a discernible plateau in pre-seed and seed funding, accompanied by a decline in the number of pre-seed rounds. This strategic caution among investors compels startups to mature rapidly to secure early-stage backing.

A 3x disparity in valuations unveils the diverse spectrum of startups in the region. However, the underlying story lies in the consistent downward trend of median valuations, a reflection of founders aligning their expectations with market dynamics.

In a crescendo of innovation, convertible notes emerge as the instrument du jour. Bridge and extension rounds witness a surge in their usage for pre-seed funding, constituting a substantial 62% of all pre-seed rounds in 2023. Valuation caps around €3M become the norm, signaling a stabilizing force in investment terms.

Estonia, retaining its funding leader status, finds itself in a captivating dance with Lithuania, whose ascent in growth capital adds a new chapter to the Baltic narrative. The emergence of unicorns, including Veriff, reinforces the region’s reputation as a breeding ground for innovation that transcends conventional funding models.

In a summary, the report unfolds a narrative of resilience and vibrancy within the Baltic startup ecosystem. Estonia, with its standout performance in startups per capita, and the rise of Lithuania in growth capital, exemplify the region’s prowess in navigating challenges and securing a prominent position in the global startup landscape. The Baltic states, once mere players, now stand as formidable contenders, etching their success stories with each milestone achieved.

Click here to read more community news.

See the study results here and here.