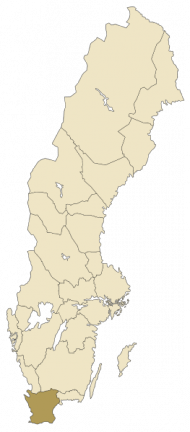

The good folks over at Øresund Startups found an interesting Masters’ thesis that looked at startup investments in Skåne, the Southernmost part of Sweden that includes Malmö, Helsingborg, and Lund. There are a few takeaways that I found interesting, which we’ll summarize, but the entire thesis can be found online. The study, Equity financing of early stage growth firms in Skåne was authored by Karl Fogelström and Christoffer Nilsson, and was done in cooperation with Teknopol.

The good folks over at Øresund Startups found an interesting Masters’ thesis that looked at startup investments in Skåne, the Southernmost part of Sweden that includes Malmö, Helsingborg, and Lund. There are a few takeaways that I found interesting, which we’ll summarize, but the entire thesis can be found online. The study, Equity financing of early stage growth firms in Skåne was authored by Karl Fogelström and Christoffer Nilsson, and was done in cooperation with Teknopol.

There are some results that entrepreneurs might find practical. It’s somewhat obvious, but, making personal connections with angels, or friends of angels is important. According to the questionnaire, 46% of the time angels find the companies they invest in through personal contacts, 22% go through formal networks, and the remaining 36% find companies through both paths.

Additionally, the most common reason why angels did not invest, was because they found the valuation of the company to be too high, which may be something to consider during negotiations.

These angels polled have been in the game a little over 7.5 years, on average, and have made 6.17 investments on average. Additionally the average amount of time reported between first contact to contract was 3.8 months, so keep that in mind when budgeting your expenses while flirting with angels.

More than half of the angels claimed they were profitable, with over 40% saying they had been more profitable than the stock market index returns at 8%.

These results could be inflated, however, as the data is pulled from questionnaire responses, and unsuccessful angels may not be as motivated to share how much money they’ve lost. The response to the questionnaires included 73 out of 150 business angels, and 15 out of 71 VC firms. The business Angels were sourced from Connect Skåne and Almi Delfinerna, while the VCs were sourced from the venture capital associations in Sweden, Norway, Denmark, Finland, and Germany.

On the VC side of the equation, they found that on average the funds were relatively old and drained, indicating less investments in the future unless more money is raised.

It may also be interesting to also read the article on Øresund Startups, which looks some different areas of the study, and also points out some extended analysis that the ROI of investing in startups in the Skåne region is 22%. However they point out this number is pretty messy, so it should probably be considered more of a fun calculation than a matter of fact. This analysis can also be found in Swedish.

Top image “Location of the Swedish province of Skåne” CC licensed from Wikimedia commons.