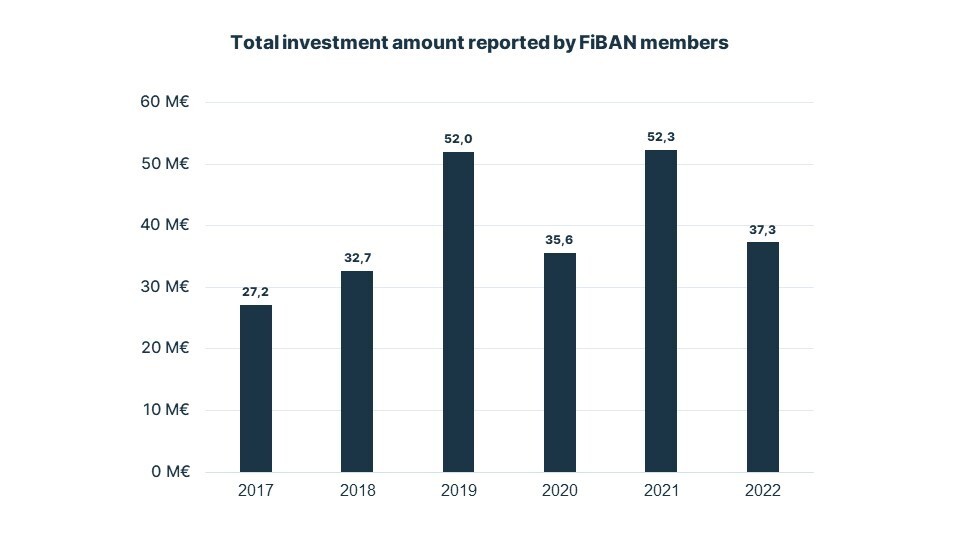

In 2022, Finnish angels invested 37 million euros in 248 growth companies, says the latest study conducted by the Finnish Business Angels Network (FiBAN), collecting answers from 450 private investors out of FiBAN’s 670 members. 7% of FiBAN members’ investments were made outside of Finland. The most popular countries were Estonia, Sweden, and the United Kingdom.

FiBAN’s annual study of investments and exits maps the development and impact of angel investments. “FiBAN members care about the societal impact of their investments. We reach a significant portion of Finnish angel investors, however, private investing happens outside of FiBAN as well” says Annukka Mickelsson, Interim CEO of FiBAN.

Almost half was invested in new startups

Finnish angel investors have remained active. The median size of an investment round increased from €250,000 to €290,000 from the previous year with a total of 791 investment rounds. Almost half of these were invested in new companies.

“Although globally startup funding has dropped by half, in Finland, the interest in new companies has clearly revived after the pandemic,” says FiBAN chair of the board Kim Väisänen.

The median investment size remained at the level of 2021 at 20,000 euros. Less than ten percent of FiBAN’s angel investors make half of all investments made through the network.

They are so-called super angels whose investments range from hundreds of thousands to millions of euros at a time.

Finnish angel investors often have backgrounds in leadership roles, as well as in their own enterprises. For many startups, angel investors are the first believers. “Angel investors’ expertise is based on extensive experience in leadership and business development. What they bring into the startup, are the networks and the desire to develop the companies. That is why angels are often desirable partners for startup founders”, says FiBAN’s Interim CEO Annukka Mickelsson.

FiBAN offers training and education for its members to support professional angel investing. “Angel investing often starts with smaller amounts and the amounts grow as experience grows. Previously accumulated wealth is often reinvested in new growth companies. Professional angel investing is significant to the whole startup ecosystem,” Mickelsson adds.

High-risk investing with bankrupts and acquisitions

The number of exits slightly decreased compared to the record year of 2021, when 168 exits were made. 122 exits were made in the year 2022, of which half were acquisitions and one-third were bankruptcies. Bankruptcies remained at the same level as in previous years.

“Angel investments are long-term commitments that should be evaluated over a longer time rather than annually. Angels stand by entrepreneurs even in difficult times. We are with the startup for up to a decade,” says Väisänen.

“Exits have changed, as various option systems have become more common in large corporate acquisitions. It has become increasingly common to keep the management involved in the transformation after the acquisition,” adds Mickelsson.

“The expected range of returns on startup investing is very broad compared to, for example, stock investing. However, high-return exits are rare, but an individual exit in Finland can have a return on investment up to 100x. “Usually about a third of angel investments drop to zero, but in some cases, the value of the investment can multiply drastically. After taxes, the profits are often reinvested in startups,” says Mickelsson.

The high valuations of early 2022 manifested as a temporary increase in profitability. “At the beginning of the year, valuations were high, and then exits were made that were larger than usual. These temporarily showed as an increase in the values of exits as well,” adds Mickelsson.

Click here to read more community news.