What gets your startup funding: the idea or the execution? Both? It’s more nuanced than that. Some founders lament that local investors ask for too much validation and give frugal valuations, while in Silicon Valley you can get cash for showing one scribbled napkin. Is this true? Yes and No.

Angel investors are private individuals who invest in the early stages of a business that is not yet proven but seems promising. The latter is determined by their gut feeling, as well as their industry and/or business experience. As angels invest their own money, they tend to be careful to pick companies doing something they understand, which also means generous help with advice, connections and mentorship.

Angel investors might invest in an idea, but the idea has to make sense to them. The problem should be real, the market should be clear, the customers should care to pay for and the team must be able to deliver and scale a viable solution to the problem.

“I invest in companies that have 2-3 founders and invest before they have customers.”

-Peter Cowley, President of EBAN

Founders should be clear who could invest in their idea. Angel investment is essentially one individual trusting another to take their money and deliver results. Any investor will require some level of proof that you are able to do so. The exact level will depend on how much the investor understands your idea and how much risk they are okay with taking. Important follow-up questions stem from that:

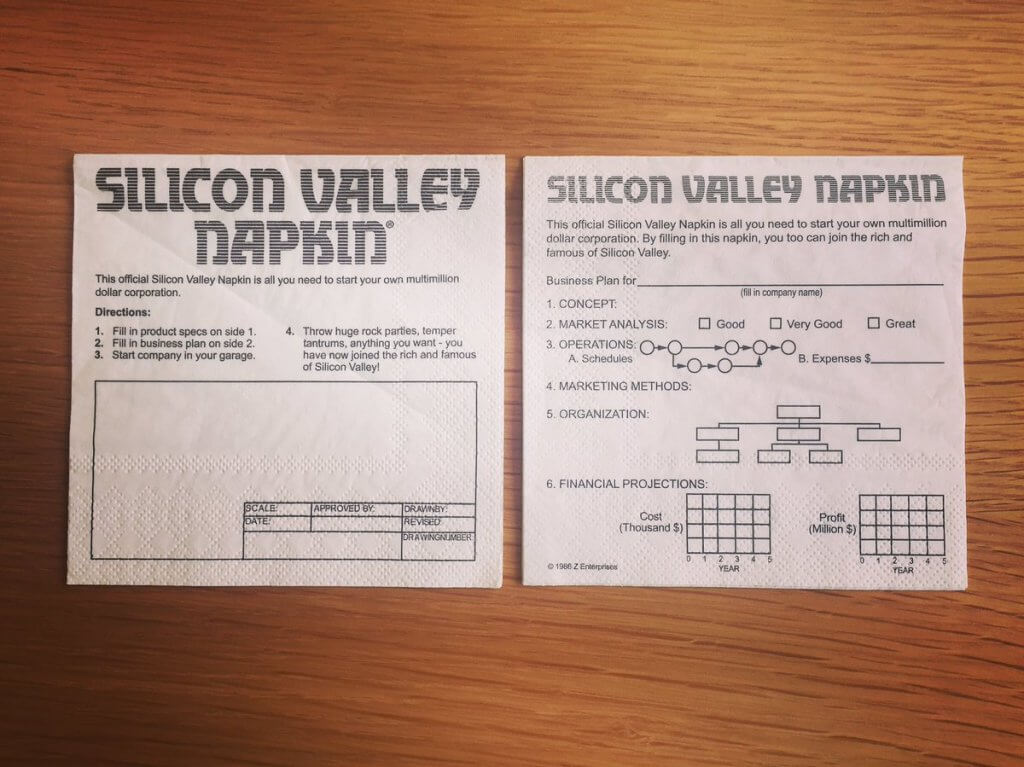

How well do YOU understand your own idea? Can you summarize it on a napkin? Yes, the stories about funding deals started with napkin pitches are true. But it is important to remember: the napkin started the deal for the investor. But NOT for the founder. The fonder spent time and effort long before, acquiring lived or professional experience, a deep understanding of the problem and solution before being able to draft it on a napkin in a snap.

The napkin is more work than a 100-page business plan. It works because it is a simplified version pitching a complicated, well-considered business idea. It works because the investor gets to ask you follow-up questions and can sense immediately whether they can trust you. Do you need to hide behind pages of data, not knowing what matters most? Do you need to look up key things? Consult with your co-founders on simple statements? When experienced investors meet a founding team who are focused, who have become one with their idea.. they can tell. This is the actual purpose of the napkin pitch – to feel you as a person.

“It is a lot of gut feeling and hunches, as it is hard to codify what makes a good entrepreneur. If I am investing in someone, I am investing in their future, not current ability. I appreciate past performance, for sure, but generally it is still a bet on their potential to grow as founders and human beings within the next 10 years. In an entrepreneurial team, I look for what I call the 3H: Honesty, Humility and Humour.”

-Peter Cowley, President of EBAN

So, will a Silicon Valley Napkin actually get me funding? Not by itself. The napkin is only a support tool, it summarizes the gist of what you are trying to do and keeps it before your and investor’s eyes as you discuss the details and answer questions. Your clear understanding of the business and demonstrated motivation and ability to execute will be more important in securing the deal.

“If the team is able to take my money and other people’s money and execute, if they are resilient, able to make decisions, pivot, then pivot again, I’m interested. If they are also good listeners, coachable, have a positive attitude and are fun to spend time with, I fund them.”

-Peter Cowley, President of EBAN

So, will business angels invest in an idea?

Yes, if:

- it is brought to them by the right team of people, willing and able to deliver;

- they understand the idea and are personally comfortable with the risks;

- the team has proven trustworthy and clear, cares about the problem and is serious about the execution: research, tests, deep understanding of the problem, real insights from real (or potential) customers;

- their gut tells them so.