Estonian-founded mobile banking service Monese has raised $10 million from investors including Anthemis and Korea Investment Partners to expand from UK market into mainland Europe with its service for expats, migrants and those seeking an alternative to traditional banks.

Monese is a direct rival to Finnish Moni, which is also expanding the service in Europe this year.

Investment into Monese represents Korea Investment Partners’ first investment in a European startup. Early backers Smartcap and Seedcamp also invested in the heavily oversubscribed round, which brings the total amount of funding raised by the company to $15.8 million.

Monese has signed up over 40,000 customers from over 179 different countries who have collectively made over 1.8 million transactions, moving over 150 million pounds, since September 2015.

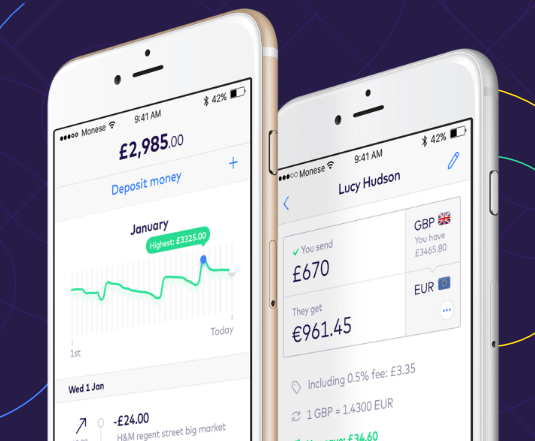

Monese is not your usual bank – customers do not need a domestic address to open an account and will not undergo any upfront credit checks. They install the app on their smartphone, take a selfie and a snapshot of their local passport or national ID document then fill in some basic profile info to open themselves a fully functional current account. The entire account opening process is automated and takes as little as 90 seconds to complete. Despite its speed, Monese assures the onboarding process involves a barrage of data driven identity and security checks ensuring each customer is who they say they are.

Customers can undertake all of their everyday banking tasks with a Monese account, including receiving a salary, shopping in store or online with their Monese contactless debit card, paying friends, family or bills with UK bank transfers or international money transfers to 8 currencies for up to 8 times less.

“The roadmap for 2017 is aimed at cementing Monese’s position as the bank account of choice for migrants, expats and people seeking alternatives to expensive accounts with legacy banks, across Europe,” the company said.

Monese was founded in London in 2013 by Norris Koppel who, while an Estonian expat in London, saw how difficult it was to open a bank account for receiving salary and paying bills.