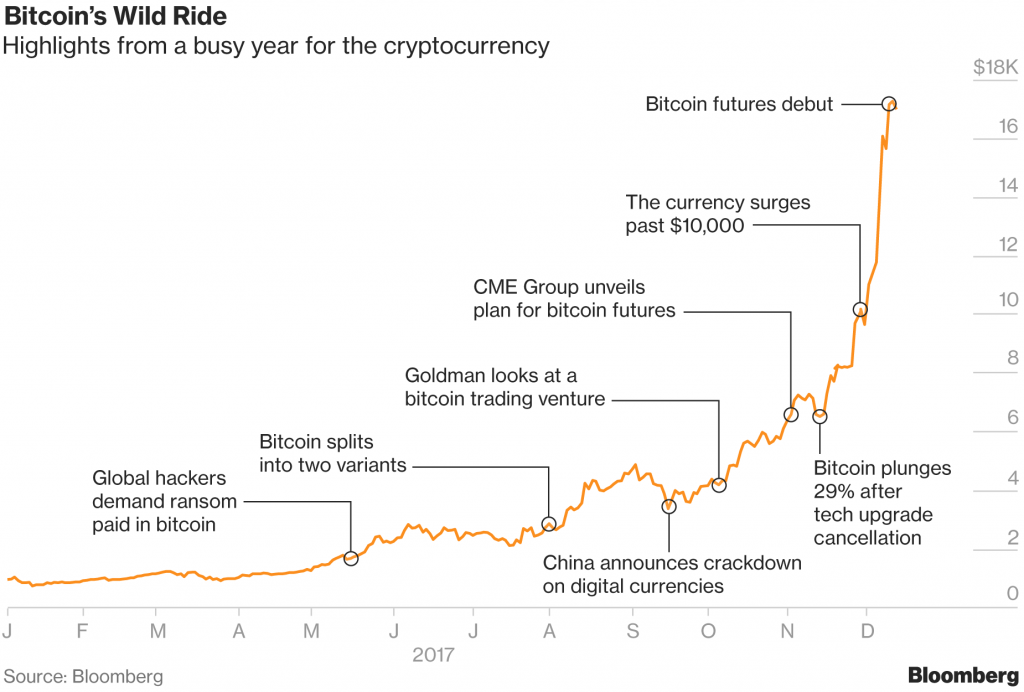

The guardians of the global economy have two sets of issues to address. First is what to do, if anything, about the emergence and growth of the private cryptocurrencies that are grabbing more and more attention — with bitcoin now sitting above 16,000 euros and futures trading this week heralding a new level of mainstream acceptance. The second question is whether to issue official versions.

Following is an overview of how the central banks in Europe and the Nordics are approaching the subject:

Scandinavia: Exploring Options

Some Nordic authorities have been at the forefront of exploring the idea of digital cash. Sweden’s Riksbank, the world’s oldest central bank, is probing options including a digital register-based e-krona, with balances in central-database accounts or with values stored in an app or on a card. The bank says the introduction of an e-krona poses “no major obstacles” to monetary policy.

In an environment of decreasing use of cash, Norway’s Norges Bank is looking at possibilities such as individual accounts at the central bank or plastic cards or an app to use for payments, it said in a May report. Denmark has backtracked somewhat from initial enthusiasm, with Deputy Governor Per Callesen cautioning against central banks offering digital currencies directly to consumers. One argument is that such direct access to central bank liquidity could contribute to runs on commercial banks in times of crisis.

What about Euro Area?

Euro Area: Tulip-Like

The European Central Bank has repeatedly warned about the dangers of investing in digital currencies. Vice President Vitor Constancio said in September that bitcoin isn’t a currency, but a “tulip” — alluding to the 17th-century bubble in the Netherlands. Colleague Benoit Coeure has warned bitcoin’s unstable value and links to tax evasion and crime create major risks. President Mario Draghi said in November the impact of digital currencies on the euro-area economy was limited and they posed no threat to central banks’ monopoly on money.

What the world’s central banks are saying about cryptocurrencies? Read the full article here.