There are some problems that most of us can only dream of having, one of which must be to be rich enough to qualify as an institutional investor. Edgefolio, a Norwegian fin-tech startup is working on fixing the way the 2.4 trillion dollar hedge fund industry markets itself to this group. Founded by London-transplant Leopold Gasteen in 2013 they are currently in beta fine-tuning their product.

There are some problems that most of us can only dream of having, one of which must be to be rich enough to qualify as an institutional investor. Edgefolio, a Norwegian fin-tech startup is working on fixing the way the 2.4 trillion dollar hedge fund industry markets itself to this group. Founded by London-transplant Leopold Gasteen in 2013 they are currently in beta fine-tuning their product.

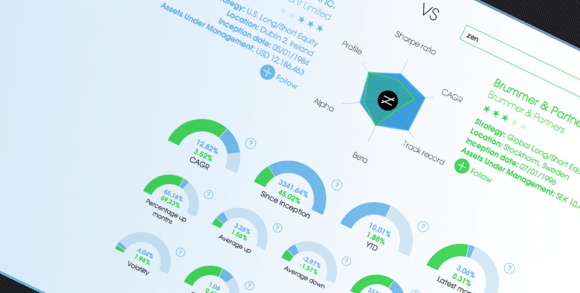

Their product is a scalable marketing platform for hedge funds that allows them to create one standardised fine-tuned investor pitch for investor acquisition. Hedge funds have always relied on cold-calling and email reach-out to institutional investors, often with extremely poor results. This turns the entire situation around and will allow investors to browse the 11,000 different funds globally in a way that’s been impossible to do before this. Since hedge funds are a lightly regulated industry, their platform will also standardise they information provide. It will be easier for investors to see the overall performance of the fund and funds will have less of a chance to cherry pick their numbers. They’ve already seen strong demand from their product from all groups of investors, from small scale private outfits to bulge bracket investment banks.

The idea stems from Leopold’s time working at a hedge fund in Oslo, where he saw “extremely clever people using very old techniques of presenting their products to their costumers, often with a very low success-rate.” In April 2013 he started working on a solution by calling hedge funds around the world from Gründergarsjen while working on the early legal compliance himself. Later that summer he put in 40,000 NOK (€4,800), managed to bring onboard Harish Narayanan as CTO leading up to today with four employees and hiring aggressively. They’ve taken on $75,000 in seed funding from Betafactory, a Norwegian incubator and Simula Innovation, Harish’s former employer, which was matched by Innovation Norway. They’ve now raised an additional $500,000 round by an angel consortium with the majority of the investors coming from the hedge fund industry.

Working from Norway solves for Edgefolio many of the HR problems you often have a in startups. They claim that Scandinavian social capital means you can put a lot more trust in your employees, with finishing the task at hand well being much more important than working hours. Other big tech cities such as San Francisco and London are already saturated by people looking for engineers so the recruitment process was a lot easier for them than it would otherwise have been.

For the sales people the job involves so much travelling anyway with the global centres by decreasing importance being New York, London Zurich and Singapore that it doesn’t really matter where they are based, and as the founder himself says, “we like it here with all the cabins and stuff”.

Edgefolio is a start up that one could not have dreamed of founding more than five years ago, using modern technology to work a global market from a corner of Europe. Very much a product of our time, the growth potential for clever solutions in an industry as antiquated as hedge funds is huge and we can’t wait to see what they get up to in the future.

Edvard Nore started Europe’s first student-led investment fund while he was a student at UCL and his first company right after that, which failed pretty miserably. He’s now working at Zoaring, helping build Norway’s startup community, as well coming up with a new genius idea.