Inspired by this article from Founders and Founders back in 2013, I wanted to give an example of how startup funding rounds really work in the Nordics. There are plenty of examples from the U.S., but I want to give a reference to how it is in the Nordic startup environments.

In writing this post, I have talked to a wide variety of VCs and startup co-founders, drawing lessons from amongst other Spotify, Podio, Truecaller, Neo Technology, Wrapp, Fyndiq and numerous VCs and business angels.

NOT THAT COMMON KNOWLEDGE

This post is aimed at anyone who feels unsure about investment rounds, taking about funding or in general, or curious what ‘startup progress’ looks like. In my, and many others, experience there are a lot of entrepreneurs – both new ones as well as those that have build companies with multimillion euros in turnover – that actually are not that informed in how funding really works. On top of this, too many ‘business angels’ do not have this knowledge either. I have seen many bad investments because of that lack of knowledge – where the funding actually inhibited the startup from getting further investments later – because it was at a valuation that was off the mark, often too low. A too low valuation means that to much ownership is given to early investors, which makes it hard, often impossible, to get later investments.

DIFFERENCE BETWEEN NORDICS AND THE U.S.?

The aim of this article is to talk about how it works for Nordic startups. Compared to the U.S. there is actually very little difference, so overall it is very similar. But we wanted to really know, that’s why I have talked to the Nordic startups themselves and use their numbers as a base.

HOW FUNDING WORKS – THE ROUNDS

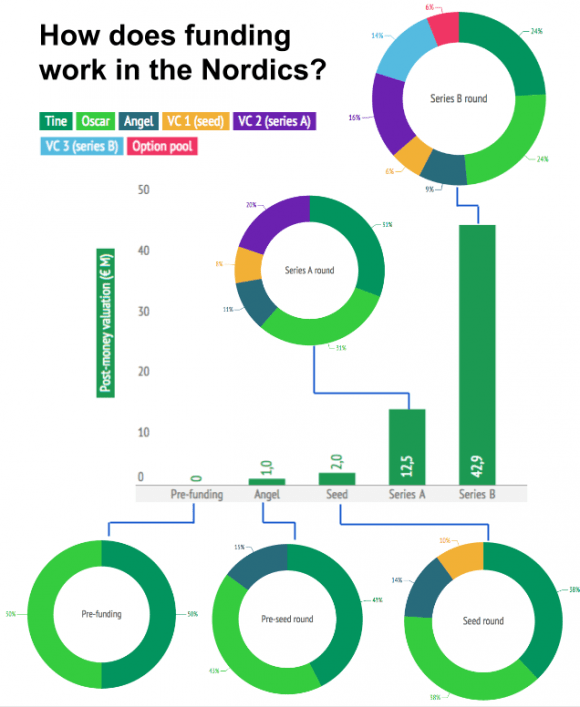

Funding is often divided into different rounds. We will go through them briefly below. What’s important to keep in mind is that the goal of investment rounds is often to grow and get to the next investment. So it is seldom that a startup only takes one round and then is set – rather a round is aimed at taking the startup to the next level, and to be able to close the next round.

Is this good? I leave that interpretation up to you, but if you want to scale globally fast, funding is the way to go – not just for the money, but even more importantly for all the doors investors can open, the advisors you get along the way.

FFF (AND GOVERNMENT MONEY)

The first round, often referred to as Friends, Family and Fools, is in the U.S. often limited to these. In the Nordics, however, government funding and loans are a part of this round as well, where they can give € 10 000 – € 50 000 for development and early prototyping. The advantage with government funding is that they often are without giving away any equity. It’s a great deal if you can handle the sometimes bureaucratic procedures. However, beware of dangers – some institutes have legal contracts that make it hard to get investors later on.

In order to make it clearer, we take an example: Tine and Oscar are co-founders of a new startup, let’s call it nextbigthing.io. To get going, they get a government innovation grant of € 20 000 – not much, but enough to get en early prototype ready that they can showcase to potential business angels, and more importantly, users. As it is a government grant they still own all the shares of the company: 50 percent each.

PRE-SEED ROUND

A first ‘real’ round is often the pre-seed. In this round the valuation of the startup is rather simple to estimate – it is either not promising at all, and is valued at 0, or it is showing promise, and is valued at € 1 million. The reason for this is that giving a valuation to a startup at this stage is nearly impossible. The startup can however be valued at a higher valuation, up to € 2 million, if the progress shown is extremely good, or it is in a very promising market or has a team of very experienced entrepreneurs.

At this stage the money raised is often from business angels, but it can also be from special pre-seed funds. With the valuation ‘set’ the equity given to an early investor or investors is often a question of how much money is needed to reach the next stage. Quite common is to raise € 100 000 – € 200 000, for 10 % – 20 % of the equity.

To continue the example, Tine and Oscar used the initial money to build a promising prototype and reach early users. They now need money to continue to focus. They talk to a lot of business angels, who they have been introduced to mostly by asking friends who are also entrepreneurs and other startups. After having met with over a dozen angels and a couple of early stage VC firms, they decide to go with an angel – a former entrepreneurs who made a great exit a couple of years ago. The angel invests € 150,000 at a € 1 million post-money valuation – giving the angel 15% of the equity.

SEED ROUND

In this round, which can be the first round as well, you often raise € 100 000 – € 500 000, depending on what you need to reach the next stage. There is no real line between when it is called pre-seed, angel round or seed round, except that angel rounds are from business angels, while seed rounds include institutions and VCs.

In our example, Tine and Oscar have now managed to get the product out to a lot of users, and the team has expanded to one front end developer on a contract basis, and one marketing intern. Being able to show that users stick to the product, they raise their next round – with the aim to use the money and the investors connections to also find a good person working for them with marketing and costumer acquisition.

Building on the contacts they had with angels and early VC funds from last year, when they raised the pre-seed round, they got back to them, as well as being introduced to new connection thru their business angel. After an initial busy period, it clearly stood out that they where a good match for an early VC, as well as the current angel investing further into the startup. At a € 2 million valuation, they raise € 200 000 in new money.

How did they reach the € 2 million valuation? This is also rather simple – just as in pre-seed rounds, there is a certain rule of thumb. If you cannot show a convincing business case, product prototype or your ambitions are not big enough, then you will probably not be able to raise any ‘real’ money at all. If the investors believe in your product and ambitions, and you are a first time entrepreneurs, then the valuation is € 2 million. If you are a second time- or experienced entrepreneur, you can often get a € 3 or € 4 million valuation instead.

These general rules exist because nobody wants to waste time – and arguing about valuation at an early stage startup is nearly impossible.

Sidenotes

It is good to know that early investments are quite often done as convertible notes instead, and the valuation is actually not determined before the next round. However, it is often caped at those limits.

Also, we talk a lot about pre- and post-money. When talking about investments, it is important to keep pre-money and post-money valuations separate. Read more here. In this article, we talk post-money as standard.

Update: It was pointed out that numerous startups recently raised € 1 million or more in the seed round, such as Airtame, Shipbeat, Lookback and Tictail. I do not know the exact valuation in those cases, but most likely € 4 million and higher.

SERIES A

These rounds are larger rounds, where a startup usually has a valuation around € 10 million post-money in the cases I looked at. The money invested here is usually € 2-4 million, often for 20-30 percent of the ownership.

The investment usually comes from a VC, sometimes in collaboration with other VCs. Sometimes Nordics VCs, but not uncommon at all with U.S. or other European VCs (often German or British) investing at this stage. Often the original angel investors connections plays a large role.

An important thing, that many stressed, is that after the series A round the founders still need to own over 50% of the company. That the original founders still control the company and have a strong incentive to do their best, was a very important detail for all serious VCs I talked to.

In our example, nextbigthing.io has now used the early investments to build a real version of the service, and it is now 12 month since the seed round was closed. For the last 5 month Tine has been at countless meeting with VCs, both in Copenhagen, Helsinki and Stockholm, but also in London and Berlin. Often while attending different conferences or events. After a longer process the first few month with a London-based VC, negotiations unfortunately broke down. However, after some very intensive work and a quick two month process with one of the bigger VCs in the Nordics, she manages to raise € 2.5 million, for 20 percent of the equity.

With the investments, the VC also made sure that a 10 percent option pool was set aside, in order to attract experienced senior management for key positions, as well as a reward for early employees.

SERIES B AND ONWARDS

After a series A investment, the next round is a Series B. This is where stuff gets really serious. Here it is a lot harder determining what is a good valuation, because this is a long way down the road. If you are a startup with a consumer product you usually have released your product internationally by now and millions of users. If you are building a SaaS or B2B product, revenue, number of costumers and churn are often very important. No matter the product, you have used the previous investments to build a team of 20-50 people. And with the Series B, you might raise € 8 – 12 million, and enlarge that team to hundred or hundreds of employees.

The investors at this stage are often not from the Nordics. The money often comes from larger European investment companies or U.S. VCs. At this stage a lot of startups have some presence in Silicon Valley – quite often because that is where the investors are located.

For our startup nextbigthing.io it has now expanded to over 30 people, with two chief officer positions being hired by senior management positions at Spotify and Soundcloud. These two also got 1,5 percent stake from the option pool each, as well as 3 early employees having 1 percent each.

The startup also has, after long negotiations that have been on the brink of breaking down completely, finally landed a € 6 million investment, by a well known Silicon Valley based VC. The investment has been for 14 % equity, making the startup nextbigthing.io valued at over € 40 million.

After a strong series B often a series C and even a series D might follow. These are, of course, often at an even higher valuations, but also much more depending of the situation. The later the round, the more specialists are involved in it also.

“THE END” – IPO

An IPO, a public listing at a stock exchange, is often regarded as the ‘goal’ for the startup from an investors point of view. In an IPO the company raises further money for a part of the equity, that can be rather small (just a couple of percentages). But also, more importantly for investors, shares owned by investors can now be traded on the public market, and sold at a profit. At this stage a lot of the money from the investments are payed back. But maybe not directly – often there is a limit on selling shares for pre-IPO investors the first 6 month.

Also, an investor does not need to sell, and can hold on to shares for the future if they believe the startup has still a lot more potential.

The IPO can be made at either a Nordic or international stock exchange. The Nasdaq and the NYSE, both in New York are by many considered the ‘top’ stock exchange.

“THE END” – TRADE SALE (ACQUISITION)

Another end is to make what is commonly referred to as an exit – to be acquired by another company. This is a lot more common then reaching IPO. An exit can be of two kinds: a real trade-sale, or an ‘acquihire’. In the first one the acquirer is seeking the product or the costumers of the startup. In the second, the acquirer is mostly interested in the founders and the team. The terms of an exit can wary widely – an acquihire can be for a very low amount, while some of the most successful exits from the Nordics have been for hundreds of millions of euros.

For our startup nextbigthing.io, they continued to grow steadily, and reached in the next 4 years over 100 million users, taking both a series C and a series D to reach that. After years of struggle, it is now time for Tine and Oscar to list the shares of nextbigthing.io, at no other place then the New York Stock Exchange…

EXCEPTIONS THAT PROVE THE RULES

Just because the above is the route regarded as optimal, it is not the only way. There are plenty of examples of startups raising very big or very small rounds in the beginning, or starting to raise money very late. However, that has often been because of inexperience, and is often something that investors don’t really like. But a great team with a great product will get funding, even if it does not take a ‘normal’ route.

BOOTSTRAPPING

Also important to note, is that funding is almost always required to really grow a startup internationally and big. There are many startups which start out without funding, which is often referred to as bootstrapping, but after a couple of years they decide to take on funding. Funding gives you access to money to grow quicker, but just important to very deep networks and connections. It can even be that founders start out being skeptical to investors or VCs, but realising along the way that funding is the right way to really achieve a successful startup and make ‘a dent in the universe’.

TIMING, KPI AND MONETISATIONS

The rounds mentioned in this article are somewhat of a ‘best case’ scenario. There are plenty of startups who have been ‘stuck’ in the seed round for 2 or 3 years. The same way as there are startups that bootstrap for 5 years before even starting their real growth.

Also, what valuations and rounds depends if the startup is B2B, B2C and wether it is making revenue or not already. In startups that have revenue from day one, such as Fyndiq, revenue is an important metric for success and future rounds, while in startups with a late monetisation strategy, such as Truecaller, number of users is a more relevant metric.

If you want to read more, this post on Quora gives good insights: how is the money spent.

About the author: Karsten Deppert is the initiator of this site, and co-founder of Contentor. He is also involved in the coworking communities Mindpark and E-commerce Park of Sweden. And a lot of other activities. You can follow him here or on Twitter. Link to infographic about the rounds and funding: infographic

–

This article is in collaboration with Øresund Startups, originally by Karsten Deppert. Øresund Startups is a news site focusing on startups in Copenhagen and the other cities around the Øresund strait; Malmö, Helsingborg and Lund. It was initiated by Karsten Deppert and covers news about startups and events from the startup scene. You can follow them at @Oresundstartups.

This article is in collaboration with Øresund Startups, originally by Karsten Deppert. Øresund Startups is a news site focusing on startups in Copenhagen and the other cities around the Øresund strait; Malmö, Helsingborg and Lund. It was initiated by Karsten Deppert and covers news about startups and events from the startup scene. You can follow them at @Oresundstartups.