Editor’s note: Here we have a guest post by Mika Marjalaakso, the CEO of Oak Ventures, and a seasoned serial entrepreneur, angel investor and startup advisor. He is now blogging about the mistakes entrepreneurs make at www.toughloveangle.com. In this series he focuses on problems he’s seen in companies participating in the Nokia Bridge program, but the lessons he draws could be interesting to any new startup. Do ex-Nokia startups face a unique set of problems? Let us know in the comments.

Editor’s note: Here we have a guest post by Mika Marjalaakso, the CEO of Oak Ventures, and a seasoned serial entrepreneur, angel investor and startup advisor. He is now blogging about the mistakes entrepreneurs make at www.toughloveangle.com. In this series he focuses on problems he’s seen in companies participating in the Nokia Bridge program, but the lessons he draws could be interesting to any new startup. Do ex-Nokia startups face a unique set of problems? Let us know in the comments.

–

fairness = the quality of treating people equally or in a way that is right or reasonable

This is part of my Nokia Startups Mistakes series. For a backgrounder, please read the introduction. My previous post discussed a special case where the CEO is a free rider, you can read it from here. This post is a lengthy one, hopefully not too dull, and discusses the more generic free rider issue that goes beyond the CEO. So please take a seat, get yourself a warm cup of coffee, and enjoy the reading.

This post is divided into three parts. First, I will describe the Nokia specific setting, then I will talk why the free rider issue is a big deal in general, and finally I will share a few tips how to deal with the free rider situation, and how to fix a broken bridge.

What is Nokia Bridge program about?

The Nokia Bridge Program, which was set up by Nokia in early 2011, aims to help Nokia employees who have lost their jobs as a result of the company’s strategy change. The program goes significantly beyond what the employment laws require in any of the countries in which Nokia operates, but was widely regarded internally as “the right thing to do”. As part of the program, Nokia supports entrepreneurship and offers seed funding for newly established companies.

I think the Nokia Bridge program itself is a truly remarkable and honorable initiative of corporate social responsibility on Nokia’s behalf. Good stuff!

The now famous Jolla amongst many others has received seed funding from the Nokia Bridge, and according to the press they have been very happy about the program.

The horizontal axis describes the ambition level of a startup, while the vertical axis identifies whether a startup was born out of necessity or not.

I have tried to illustrate in the picture above how new companies coming out of the bridge differ from each other. On the left hand side, we have lifestyle businesses from restaurants to flower shops – in essence people employing themselves through entrepreneurship. On the right hand side we have startups that are aiming to be more scalable. On the top right quadrant we have the most promising new ventures, highly motivated top-notch teams (I hope) that have the right attitude with raw product ideas (idea 1,2,3,4 …), or more mature product ideas stemming from the know-how of technologies, markets etc. that the team has acquired while working for Nokia. On the bottom right quadrant, we have perhaps the largest number of new ventures with the right attitude (or not) and perseverance to build a scalable business but still searching and iterating the core problem to be solved, and their hunger more based on necessity entrepreneurship.

I happen to think a good marriage may result from a conventional dating as well as from being accidentally drunk in a bar and ending up having a one night stand with a stranger. This, analogically, means that I also choose to believe that unless otherwise proven, great things – including lifestyle and scalable startups – can be built even the initial trigger would have been the non-conventional necessity. If I am right, this is good news.

The free rider issue is valid for all companies. It, however, is much less vital factor for lifestyle businesses. Why is this? Well, if there is a free rider issue in a lifestyle business, it doesn’t prevent their growth to the same extent it does in scalable startups. And issues with co-founders in lifestyle businesses are perhaps a bit easier to solve with small money as future expectations and valuations are much, much lower.

For a scalable startup, a free rider on board entails stormy weather. Most Nokia-based startups I have discussed with are overall very satisfied to the Nokia Bridge program (and they should be!) but also think that the existing Nokia Bridge program structure and its terms are a bit foolish, as they on their part practically bias and corrupt the ownership structure and support equally distributed ownership, which may not reflect well expected contributions per co-founder.

I share this view.

What’s wrong with the bridge then?

After pondering this question for a while, I came up with the following three factors – one related to bridge terms, two to the setting itself – that are likely to increase the probability of free riders in Nokia-based startups:

- The Nokia Bridge seed funding structure and terms. The Nokia Bridge seed funding key deal terms are as follows: i) 25,000€ per employee, max. 100,000€ / new company and ii) to be eligible, a minimum equity stake per co-founder is set at 25%, that needs to be held at the minimum one year. These terms alone create a distinctive monetary incentive to form teams of four to maximize the available seed funding. I think that having four co-founders is too much, and increases the free rider risk. No one owns a majority equity ownership to be in charge, which makes it more difficult to solve the free rider issue should it emerge. The question of how many founders is optimal, is a controversial topic. Mark Suster – a famous VC, entrepreneur, and blogger – has two related blog posts on this topic here and here that I suggest you to read.

- Democratic corporate culture that embraces working in teams and political correctness (a guess!). What if you realize just prior to incorporation that your colleague may indeed be a free rider in the upcoming startup context? Do you have balls to voice that out in a constructive manner while endangering your important friendship? Many first time entrepreneurs who are used to not to piss of their bosses and conform, yes – they remain silent and accept. (The feedback I received from my sources within Nokia on my first post was mixed. Some had liked it a lot while others had thought it to be politically incorrect.)

- Opportunistic vs. necessity entrepreneurship. Many of the Nokia startups rising are born out of necessity. This may have some impact on the free rider issue, as when you are building a scalable startup you naturally structure it for growth and also receive higher quality advice for free, while a startup for necessity is exactly that, you create it to pay the bills and having free riders onboard might not perhaps be your first priority.

Why a free rider situation is such a big deal?

Let’s first define what is a free rider.

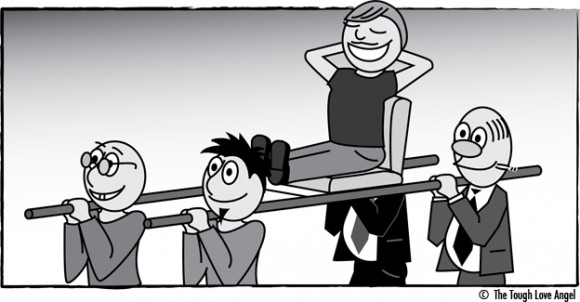

A free rider is someone who enjoys the benefits of an activity without paying for it. In startups, the free rider issue deals with the question of how to prevent free riding, and should the free rider problem arise how to limit the negative consequences for the company. The free rider issue is very common in all startups and it can be born from a number of reasons along the journey, and – most importantly – if left unresolved, it can develop into a cancer that kills your company.

Each co-founder with a working shareholder status is expected to leverage their competence and put in hours day in, day out for the success of the company. A co-founder whose skills and contribution are not relevant for a startup on a daily basis is essentially a free rider. Non-working shareholders, excluding investors, i.e. advisors and board members are also free riders if they don’t contribute commensurate with their compensation and set expectations.

A collective sense of fairness is a key factor in a great startup culture. A free rider in a house is essentially a continuous attack against sense of fairness, and thus against the great culture. Fairness is important everywhere but it is far more important in a small startup where co-founders are paid low salaries, and still expected to move mountains. It is also good to remember that fairness is not an exact science but rather a highly perceptional and emotional matter influenced by one’s personal preferences, prior experiences and values.

You can have free riders in the very beginning, they may emerge especially when you pivot and the required competences change, or a co-founder may face a sudden situation in his private life that limits his contribution. In the beginning, for instance, you may have a specialist onboard as a co-founder whose services are needed only periodically or half-time. If that is the case, don’t be mistaken, what you have is indeed an advisor disguised as a working shareholder, who should accordingly have an advisor equity stake, not a stake reserved for a working shareholder, and thus definitely not a quarter of a new company.

In addition, I have occasionally come across to free riders that I call as option holders. In this particular situation, there is an agreement amongst co-founders that others start immediately at low salary while the remaining co-founders join as soon as there is “an adequate funding” in place to pay reasonable salaries (which often are not reasonable, by the way). This, frankly, is absolute madness, as the working co-founders take all the risk while the option holders look from the balcony and wait and see what happens. So, free riders emerge at all times and take many forms. Beware!

I have summarized the key ideas of the free rider issue into three main points below:

- A free rider situation occurs when there is not strong enough fit between what a startup needs now and what a co-founder contributes – on a daily basis

- A startup is a dynamic beast, as it should be. Things change over time. It is life. It is the norm. These changes occasionally give birth to a free rider situation.

- A free rider situation when it arises must be solved swiftly. Why? Because it influences the all important culture, and a scalable startup just can’t afford any extra fat.

How to deal with a free rider issue?

A free rider issue is a way easier to prevent than fix. Here is my check list:

- I strongly recommend co-founders, prior to founding a company, sit down and engage in these profound what-do-I-bring-on-the-table series of discussions. Potential free riders are spotted and a capital table that is collectively perceived as fair is nailed down

- Things change over time, and especially so in a dynamic startup – and there is nothing wrong with that!

- A shareholders’ agreement, especially the stock vesting schedule, helps co-founders deal with this change in a predetermined way.

“A free rider in a house is essentially a continuous attack against sense of fairness, and thus against the great culture. A free rider can kill your company.” says the Tough Love Angel.

If you do have a free rider issue, and the shareholders’ agreement alone doesn’t help you to solve it, what then? First you need to asses the depth of the issue, i.e. do the free rider own 2% of your company or, say, 40%? Sometimes it is just okay to let the free rider go, and let him keep the equity he may not entirely deserve, as dealing with a free rider is an energy drainer. The typical tool box how to get rid of a free rider and not let him walk a way with an unearned compensation is as follows:

- First trying to be really nice and explaining why he can’t continue anymore in the company (this usually works only in the very early phase when the other co-founders still can easily set up a new company with no IPR etc. problems).

- Applying increasing amount of social pressure (this is also hard for many, as the free rider after all might be a really nice guy or even a close personal friend, not just producing anything valuable for the company).

- Playing a cat and mouse type of negotiating; offering nothing while the free rider wants everything, and then ending up something in the middle, but preferably closer to nothing.

- Assigning non-meaningful tasks for the free rider and excluding him out of everything that has any significance for the company.

- Being a cold asshole.

As you can see, you really don’t want to go there. No one wants be an asshole. Likewise no one can’t stand being a subject to this kind of treatment for long either. There will be a solution but it can take some time, and this process itself can easily kill any company too. This is CEO’s job. And while giving this treatment to a free rider, the CEO’s focus is only in that – he becomes quite useless too. So, it definitively is an excellent idea to craft and sign a shareholders’ agreement that helps you all stay sane and deal with these issues, as they arise, in a more humane and more predetermined way.

And finally a few ideas on how the fix the broken Nokia bridge.

How to fix a broken bridge?

Idea and contribution first, funding second. Please do set the target equity shares based on what is your best assessment on what each co-founder brings to the company in the long-term.That’s what matters. Additional 60-70,000 euros more capital is extremely lousy reason to screw your capital table – definitely not worth it.

I suggest you would craft a specifically tailored shareholders’ agreement (shortly just “SHA”) to work around the inherent flaws in the Nokia Bridge program, with the following key elements:

- Figure out who brings and what over the next four years; and divide the founders’ pie accordingly (contribution-based ownership structure).

- Start with the capital table (e.g. 4 x 25%) that optimizes for the bridge funding (nokia-brige-driven ownership).

- After 12 months has elapsed, enjoy the automatic switch from the the nokia-bridge-driven to the contribution-based ownership structure.

- Four year vesting for all co-founders with one year cliff; a buy back option to buy out and pay back the departing co-founder’s Nokia Bridge money on a pro rata basis

I think it would make a lot of sense to have this kind of SHA available for everyone interested. If any of the Nokia Bridge teams thinks this would make sense, please do express your interest by sending an email to mika (at) marjalaakso (dot) com with your name, your company’s name, and contact information. I have arranged a deal with a really good lawyer in Finland, that in case if at least ten teams think this makes sense, he is willing to prepare a standard Fix-the-Nokia-Bridge-SHA at around 500€ / team (I am not getting any money here but just thought this would be a practical, while politically incorrect, way to solve this problem). If there is a strong interest towards this, the best would be to pay once,and get the basic template free for everyone.

I would like to conclude by saying that overall the Nokia Bridge program is an admirable thing and shows great corporate social responsibility on Nokia’s behalf. So, it is a great and positive thing. Any scalable startup, however, must build their ownership structure solely based on co-founders’ contribution expectations. Please do not screw your ownership structure because of the Nokia bridge. It is quite okay to start a company just by yourself, or with one partner – available funding terms should not drive really any important decisions like the number of co-founders, and how to divide the founders’ pie. That’s it.

I hope you will enjoy this series, the thoughts it provokes, and the discussion it triggers.Please do participate to the discussion by sharing your own angle and experiences on this topic, or commenting on something, anything on this post. The preferred place for discussion is the Facebook page at https://www.facebook.com/ToughLoveAngel.

If you would like to get notified of a new post, please follow me on Twitter, and subscribe to the blog and its Facebook page.