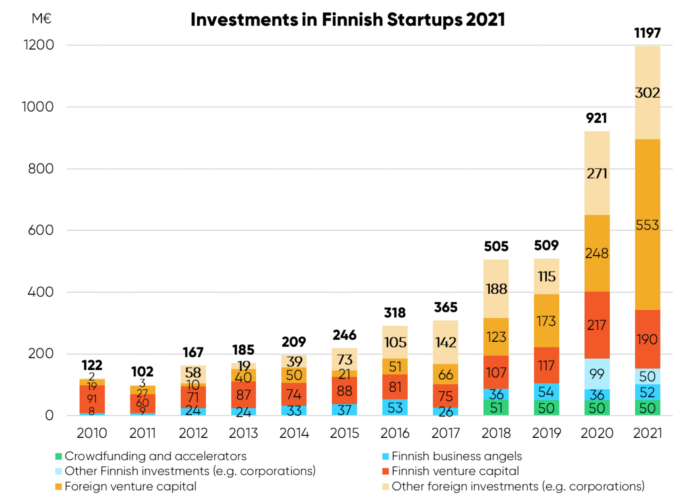

Finnish Venture Capital Association has conducted research on venture capital market progress and startup funding in 2021 and the results are refreshing. According to the research, Finnish startups are experiencing another record in history. In 2021, they raised a total of 1.2 billion euros which is the highest yearly amount so far.

Apparently, foreign investors were highly interested in the Finnish startups since the study shows that 553 million euros were raised from foreign venture capital investors while other groups like foreign companies and private individuals were backing the Finnish startups with a total of 302 million euros.

According to Pia Santavirta, the managing director of the Finnish Venture Capital Association (FVCA): ‘’Finnish success stories attracted large amounts of international funding also last year. The share of foreign investments in the total amount invested in startups grew to 71 percent, totaling to 855 million euros.’’

The domestic venture capital investors made their presence felt by investing around 190 million euros in Finnish startups. Finnish angel investors backed startups by putting around 52 million euros to the table while Finnish crowdfunding went for it with around 50 million euros. As for the other actors, the number was approximately 50 million as well.

The total amount of startups that raised venture capital last year was 182. Finnish startups received venture capital twice times more compared to the previous year.

Startup funding hit new records

Finnish startups raised 1.2 billion euros in total during 2021. This capital was mostly channelled through both domestic and foreign venture capital investors (€743M). The number of investments by foreign venture capitals doubled in a year, clearly. The study points out that a €355M share of this capital was from foreign investors which shows a 71% increase. Wolt, Aiven, and Oura scored the largest funding rounds and now they got a “unicorn” label for their brand. In total, we have now 10 unicorns in Finland.

“So far ten unicorns, startups that have broken the one billion dollar threshold, have been raised in Finland. These include Wolt, Aiven, Relex, and the newest being Oura. Nearly all of these companies have had venture capital investors to support their growth. A larger and more diverse group of investors undoubtedly have better possibilities of supporting the next round of cutting edge startup ideas that have the potential to grow into future market leaders”, says Santavirta.

Private equity investors are the largest investor group in startup investments

Finnish companies received over 200 million euros more than the previous year in terms of venture capital investments. The total amount was €743M of which €553m was from foreign VC investors. 37 of 182 startups that received VC investments were backed by international sources.

According to Janne Holmia, partner at the international private equity fund Verdane and chairperson of the board at FVCA: ‘’Finnish startup field has become more diverse during the last couple of years. Previously a major part of startups provided services for other companies, but recently the best consumer service companies have enjoyed massive growth rates. Wolt and Swappie are good examples of these types of companies.’’

Both early and later stages saw an increase compared to the previous year. Seed-stage investments had reached the amount of €19M last year, but now the number was €45M which is the most percentual growth (+ 137%). As for later stages, the amount was increased compared to the last year. The amount invested in later stages was €540M in 2021 while this number had been €302M the year before.

The FVCA also mapped the Finnish startups invested and it shows that the success was felt around all over Finland. After Uusimaa with €646.7M, most of the investments went to North Ostrobothnia with €52.5M.

Domestic investors reached all time high investments

There was another record on Finnish VCs’ end. In comparison with the previous year, the total amount invested by Finnish VCs into domestic and international companies saw a 5% increase which refers to €294M in total. The most significant increase was shown in later-stage ones. 237 companies received investments from Finnish VCs in 2021. This number had been 242, meaning a 2% decrease.

Yet, it can be seen a 12% increase since 10 more companies received funding in seed stage, going up from 85 to 95. The study also points out the fact that Finnish VCs found more foreign companies than the year before (from 63 to 105) while there were fewer domestic companies (from 217 to 190) that received investment from Finnish VC investors.

According to Santavirta: “Seed-stage investments by Finnish venture capital investors have almost doubled in a year. These investments create possibilities for new success stories. There is international interest in the know-how of Finnish venture capital investors. 36 percent of Finnish venture capital investments were made in foreign startups. Strengthening international networks also benefits the Finnish startup ecosystem.”

Private equity investors have a record amount of funds to be invested in startup companies

Thanks to successful fundraising in recent years, the total assets managed by Finnish venture capital investors have risen to nearly 2 billion. Though a portion has already been invested in various startups, 935 million euros is still available for new investments.

’’Successful fundraising is explained by many factors: Finnish funds have become larger in scale, investment activities have become more international, fund returns have been excellent, and we have witnessed numerous success stories in the technology sector. The success of Finnish venture capital funds is enticing to more and more fund investors’’, Santavirta continues.

In recent years, six Finnish funds have crossed the 100 million threshold, which is only the average fund size in the context of European venture capital funds. In addition, there have been newly founded sector specific funds, such as FOV Ventures that’s solely focused on the metaverse, Nordic FoodTech VC focuses on food technology, Sparkminds.vc focuses on educational technology and Voima Ventures focuses on deep tech.

Click here to read more community news.