If you’re living in Europe and have been waiting for a personal finance tool like Mint to integrate with your bank and credit cards for a breakdown of your spending habits, the good news is that you might not have to wait too much longer. On Friday news broke that Stockholm-based personal finance app Tink has raised a $4 million (€3.1 million) funding round led by Sunstone Capital to start expanding across European markets and eventually make its way to the American shores.

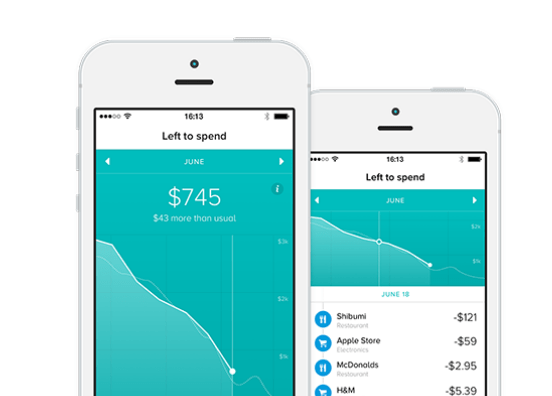

For a quick breakdown of the app, Tink’s service is a mobile-first finance tool that provides its users a clear and easy breakdown of finances. For instance, Tink allows you to see a graph of where you are in your monthly spending and compare it to your budget is on average. Other features in the app show you where you’re putting your money, or to help you set goals to get better about saving or to budget for big expenses, which might come in handy for some of us out there. To save a little time for those of you outside of Sweden looking to download Tink right now, switching over to the Swedish app store won’t let you integrate to your pan-Nordic bank (I tried).

Since launching in Sweden roughly a year ago, 200,000 people have registered for an account in the service, which while not an absolutely massive number, is very respectable for grabbing more than 2% of Sweden’s population.

“Personal finance doesn’t have to be boring or time consuming. We make something that in just seconds gives you valuable, fun and actionable information about your spending” said Tink CEO Daniel Kjellén. “The fact that Tink is fully automated and everything is presented in a feed format makes it useful even if you only have 2 minutes to spare. We think this is key to why the typical users is a 23 year old female, using Tink 2-3 times per week.“

With the investment, Sunstone’s Christian Lindegård Jepsen will join Tink’s board.