In the lead-up to interviewing Safello CEO Frank Schuil, I sent him an academic paper I came across that poked holes in the idea that Bitcoin users could remain anonymous. “Put on your tinfoil hat”, he wrote back, “Bitcoin is easier to trace than any other currency in the history of mankind…There are hints and rumours that the NSA [American National Security Agency] were the original creators of the protocol for this specific reason,” and attached a 1996 NSA report on electronic cash and how the absence of an electronic trail would magnify the problems of detecting counterfeit coins, money laundering, and tax evasion.

In the lead-up to interviewing Safello CEO Frank Schuil, I sent him an academic paper I came across that poked holes in the idea that Bitcoin users could remain anonymous. “Put on your tinfoil hat”, he wrote back, “Bitcoin is easier to trace than any other currency in the history of mankind…There are hints and rumours that the NSA [American National Security Agency] were the original creators of the protocol for this specific reason,” and attached a 1996 NSA report on electronic cash and how the absence of an electronic trail would magnify the problems of detecting counterfeit coins, money laundering, and tax evasion.

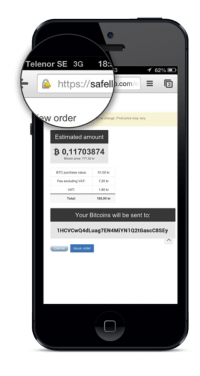

This is the reason that newly-started Safello isn’t really focussing on the anonymity of Bitcoin. They argue that in order for Bitcoin to mature into a widely-used currency, it needs to buck the reputation of being primarily used for illicit transactions, including drug sales and fraud. Safello plans to be part of this new wave of Bitcoin by bringing their Bitcoin transactions into line with existing legislation to make sure that both Bitcoin sellers and buyers are protected.

To this end, Safello focuses on two other elements of Bitcoin that are extremely useful for consumers – the speed and convenience of Bitcoin, especially for cross-border and international transactions. Schuil pointed to how Bitcoin has been used in places where conventional banks don’t or won’t operate, like in parts of Africa.

Of course, as a Bitcoin reseller, their focus is primarily on providing infrastructure for the sale and purchase of Bitcoins. However, says Schuil “at this stage, we also have to market Bitcoin itself.”

Started in July this year, Safello’s online trading site went live on August 21 and celebrated its first transaction shortly thereafter. Schuil says that the company “…has built up liquidity in Bitcoin and hooks into other platforms to match any price on any exchange.” However, what he thinks sets them apart from existing exchanges and re-sellers, like Mt Gox, is both their transparency and the fact that Sweden has such a good reputation abroad, particularly among Europeans. “Rather than dealing with Mt Gox, which is based in Japan, and transmitting your money to their bank account in Poland, you just deal with one company, in one place,” says Schuil.

And it sounds like both the Swedish authorities and banks have welcomed the re-seller, as Safello has established a corporate account with a major Swedish bank and has received clear guidelines from Skatteverket, the Swedish tax authority, on how Bitcoin investments should be treated for tax purposes.

It’s hard to really tell how big Bitcoin will get, but Schuil argues that the deflationary currency is still at the stage where existing users are “early adopters” – the “early majority” are still to come. Moreover, although the number of Bitcoins is ultimately limited, the number that can still be mined is huge and should only run out in 2140. But because there is such a need for Bitcoin in a global economy, its growth could be fast: “[It] could go as viral as Facebook, even,” says Schuil.

Safello, with Stockholm School of Economics and the Stanford Alumni Club, held their first Bitcoin event BitStockholm last night. Apparently we’re to keep our eyes peeled for more activity!